Hey everyone! Hope you are doing well in your lives and have started earning some money. So, if you are earning some money, this blog-post is for you. Even If not, you can still read, of it will help you in future when you will start earning.

So, just give me a quick favour by commenting down your thoughts about this post, share it to your friends and family members; trust me, it will help them a lot. If you will do these steps, it will mean a lot for me as it takes me 1 month to understand it fully by reading several books, watching multiple videos, and presenting it to you in easy vocabulary that every guy can understand it easily without any cost took me consequent 8 hours to write without any break. So, I again request please do it for me!

If you intelligently read this blog, I can guarantee you that you will know more about taxes than a Chartered Accountant (CA). Without wasting your time let's move to the topic:

Indian Tax System Is Divided Into Two Types of Taxes:

1) Direct Tax :-

Direct Tax is also called Income Tax in India. As the name depicts, it is levied directly from individuals or businesses. It is the tax that you pay on your Annual Income. It is levied on the income including Busines Profits, Capital Gains (profit generated by selling an asset), and Salary. This tax system follows Progressive Structure I.e the higher your income; the more taxes you pay. Basically, it is non-discriminating. But, but, but, it's not true. Most of the financial experts will say this is, but as usual it's not true. Why? There are individuals like my mentor Robert Kiyosaki, Elon Musk, Jeffbezos etc. pay literally zero income tax. Yes! You heard it correct, ZERO!!! Even, their income is 1 lakh times more than us. Don't worry, will upload next blog on this topic; How To Avoid or Eliminate Taxes. If you want me to upload it, so comment down. Back to the topic, next we will learn how Direct Tax is levied and what is the mechanism.

Mechanisms of Direct Tax And How It's Levied:-

It causes most burden to salaried folks or individuals because they have to first pay tax before receiving their salary. Hah! Yes, you heard it correct. They have to pay monthly TDS (Tax Deducted At Source) before receiving their salary. It's usually upto 1% of their salary. And at the end of a Financial Year, they also have to file an ITR (Income Tax Return) in which they pay income tax but the employees claim TDS while calculating the i

Income Tax. So, they pay TDS as small portion for income tax and at the end of the Fiscal Year, they pay the outstanding balance. So, why TDS? Why they don't pay lumpsum amount at the end of Fiscal Year? It has a great reason that my father told me and no one will tell you this what I am going go say you. The TDS is a small portion, only 1% because the government wants to estimate the monthly income of the employee. Why they do this? Because, if a person files a false ITR by showing his income less than his actual income. It means he can easily reduce taxes but government don't want to happen this. So, they know your actual salary by deducting a small portion from your salary as TDS. By this they get an idea what's is your actual salary. So, the taxpayer would pay exact same amount as he is eligible. No theft! Mastermind!

But the businesses don't pay TDS and they pay taxes on the Outstanding Profit I.e if any business generates profit of 10 lakhs, they will not pay tax on these 10 lakhs. They will pay tax after deducting their Business Expenses and Depreciation. In simple: Employee – Earns 》Pays Tax 》Spends. But Businesses – Earns 》Spends 》Pays Taxes. Why this favoritism for businesses? It has a solid reason. To understand this let's take an hypothetical example. Consider a business that is burning money I.e no profit. What if the government levies tax on revenue not on profit. It means a business which is already burning money has to pay taxes without earning money. WTF! It's unfair. That's why businesses pays tax on the profit that is left after all the Expenses. In other words, businesses get Business Expenses and Depreciation while accounting taxes. And also businesses provide stability in country by providing jobs and boots economy. That's why government gives them incentives to reduce taxes. So, this was all about Direct Tax or Income Tax.

So, this was all about Direct taxes, if you have any confusion you can mail me at ahtishamasiftantray@gmail.com where I can give a free webinar about the whole concept. Feel free to ask! 🥰

2) Indirect Tax :-

Indirect Tax is also called GST (goods and services tax) in India. As the name also depicts, this tax is levied from every individual or business indirectly. It's levied on the fianl price you pay for products or services on each stage of Production and Distribution. Businesses also pay GST on thier Inputs (raw materials) at every stage. As Direct Tax is collect directly by the government but here GST is collected by businesses and then businesses gives it ro government. But here is an issue businesses also pay GST and also collects. But, Man! This is unfair! Yes!!! Here the ITC (Income Tax Credit) save individuals like me who are running a business. In ITC we claim Tax Credit on the tax we pay on inputs against the GST we collect, which elimintes Tax Cascading (paying tax more your have to). So, by ITC the individuals like me take a relief by claiming tax credit. Uff My God!! 😮💨 So, by the god level thinking of government by introducing ITC ensures seamless, and effective taxation system by preventing Double Taxation.

Businesses acts as a middle man by collecing tax from end consumers and the gives to government. Therefore, it's called Indirect Tax. This tax is discriminating because a poor person pays the same amount GST on products or services as a billionaire Mukesh Ambani does. Government tries to make it little bit more equal.

To Make Indirect Tax Equal, Government Do The Following Things:

To make Indirect Tax more equal government don't levies GST on essential items. For example products like vegetables, milk, food etc government don't take any GST for these items.

For less essential items, government charges 5% of tax. Products like soap, clothes, shoes etc government charges less GST.

The concept is simple, the consumption of essential items attract less GST; the consumption of less essential items attract little bit more GST; the consumption of sin items (items causing you harm to your health like tobacco, alcohol) attracts more GST; the consumption of luxury good attracts more GST.

What is Cess:

Cess is an additional tax levied on luxury goods or services to support a specific fund. Government charges Cess to make GST more equal.

Cess usually have two motives:

1) As a fine for buying luxury and sin items.

2) As to support specific funds e.g Swach Bharat Cess.

What is Advance Tax:

Advance tax means paying Income Tax in advance in four quraters in a year. But, some specific taxpayers are eligible for it. The taxpayer whose Total Tax Liability above ₹10,000 after deducting The Total Annual TDS. If it exceeds, you are eligible for Advance Tax. So, you have ro pay Income Tax in 4 quarters in a year a specific date e.g 15 April, 15 July, 15 October, and 15 January. But what for the businesses that they don't pay TDS. It's a good question. So, if the business exceeds only ₹10k income tax liability, it is eligible for Advance Tax without even deducting The TDS because they don't pay.

What is Old Tax Regime:

It's the old taxation system that India used or currently uses. This is the old type of tax system in which Income Tax Slabs have high Income Tax but have more tax benefits under the Section 80C. So, this tax regime is for those taxpayers who has more Depreciation (tax benefits).

What is New Tax Regime:

It's the taxation system which was introduced in February 2020 by the Finance Minister Nirmala Sitharaman. This system allows individuals ro pay less taxes but has less deductions. So, this one is suited for the taxpayers who don't have any Depreciation.

What Are Income Tax Slabs And It's Rates:

In my wording, income tax Slabs are predefined ranges of income which has a specific tax rate levied.

So, the below image is the Income Tax Slab Rates In India Including Old And New One :

Bonus Tips For Choosing Tax Regime:

In India, you have right to speech, religion and more. All over rights. Our constitution is full of rights. And we also have a right to choose Tax Regime; Old or New.

Most are confused which to choose, but remember if you don't have choose any Regime. By default, you employer will take you Regime as new one. But you ro right ro change. But, bur, but, only you have one chance to change. So, change wisely!

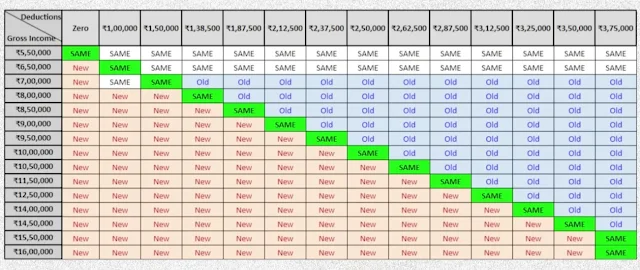

Here Is The Cheat Table For Choosing Which Tax Regime To Choose:

Disclaimer*

I'm not any financial expert, I am just a 8th grade student and an entrepreneur. Just, I am sharing my thoughts. So, do research before taking any decisions.

So, it was all about it. If you have understand it fully. Trust me, you know more than a

Chartered Accountant. And if you have any doubt you can mail me at

ahtishamasiftantray@gmail.com for a free webinar.

Bye all of you! Wish you a good financial life. Thanks for reading and don't forget to share and comment. Bye!!!! 👋

*Proudly Written by Ahtisham Asif Tantray*

Best! The way of understanding such complicated topic is really awesome 👍

ReplyDelete